- The company's bid is the latest to join the list of bids made by other technology firms seeking to acquire Mellanox.

- Other prominent bidders interested in buying the company include Intel Corp., Xilinx Inc., and Microsoft.

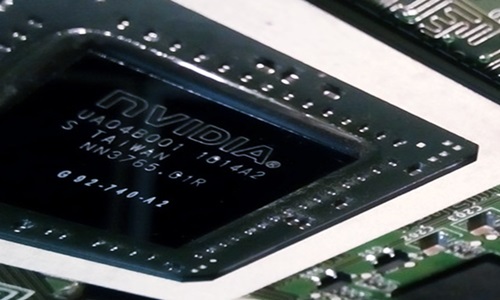

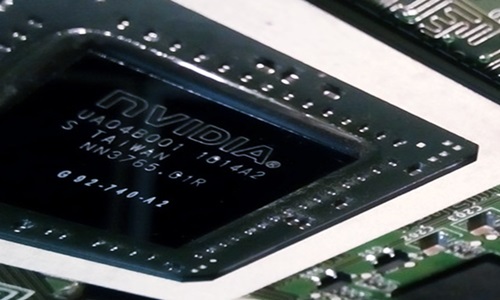

Nvidia Corporation (Nvidia), a renowned Silicon Valley based computer gaming giant, has reportedly offered to acquire Israel-based chip manufacturer, Mellanox Technologies Ltd., (Mellanox).

Reports cite, the company's acquisition bid is the latest to join the list of bids made by other technology firms seeking to acquire the Israeli chipmaker. Other prominent bidders interested in acquiring the company include, Intel Corp., Xilinx Inc., and Microsoft Corporation.

According to a report by

Bloomberg, amid the increasing interest, Mellanox's market value has reached approximately $5.9 billion. Nvidia, at the moment, is the highest bidder with its bid moving ahead of the ones made by rival bidders, including Intel Corp.

Intel had reportedly offered to pay over $6 billion to acquire the chip maker. It is being estimated that any final deal would probably be about 10% higher than Intel's bid. Mellanox shares have surged more than 51% over the previous 12 months amid its acquisition speculations & it reporting record revenues in 2018.

Nvidia would reportedly have a considerable advantage over Intel as it has a better chance of obtaining both Chinese & US regulatory approvals, owing to Intel & Mellanox controlling the InfiniBand technology market.

For the record, Nvidia has also been active throughout Israel over the previous nine years by both acquiring stakes inside startups & establishing its R&D unit and locally selling its processors. As of the August of 2018, the company has invested several million dollars in Israel to grow its business influence in the region.

According to reports, additional information pertaining to the ongoing acquisition bid has not been unveiled by any of the involved parties as a deal has not been finalized yet.