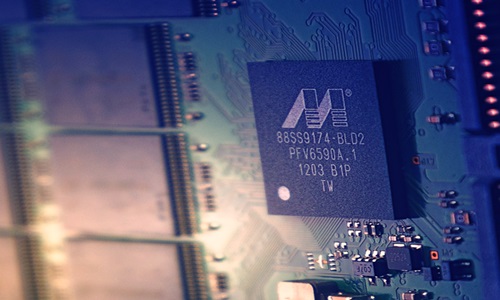

With the proficient design team of Avera and leading technology of Marvell, the company is expected to be better positioned to capitalize on expanding prospects in wired & wireless infrastructure. Marvell Technology Group Ltd., a storage, communications and consumer semiconductor manufacturer has recently announced the acquisition of custom-chip business owned by GlobalFoundries Inc., Avera Semiconductor LLC. The acquisition deal was closed at $650 million and is expected to have a potential earn-out of over $90 million, depending on the performance of the company over the next fifteen months. For the record, Avera Semiconductors was previously owned by International Business Machines Corporation and in 2015, it was acquired by GlobalFoundries. The acquisition includes transfer of business, system manufacturer agreements along with intellectual property, the latter being the crucial part of the deal. Avera Semiconductor makes application-based integrated circuit chips, that are used in wired & wireless infrastructure. As per reliable sources, Avera has executed more than 2,000 complex designs in its 25 years of existence and has built a significant business maintained by 800 technologists. Its product listings include analog, mixed signal & system on a chip design along with a portfolio that consists of high-performance embedded memory & advanced packaging technology. According to Marvell, the acquisition will help the company to become a leading supplier of infrastructure semiconductor solutions across the world. Matt Murphy, president &CEOof Marvell, reportedly quoted saying that the acquisition of Avera will facilitate the company to offer a complete spectrum of product architectures covering standard, semi-custom to full ASIC solutions. With the proficient design team of Avera and leading technology of Marvell, the company is expected to be better positioned to capitalize on expanding prospects in wired & wireless infrastructure, starting in the speedily growing 5G-base station market, Murphy added. Reportedly, Marvell Technology Group's last large acquisition was Cavium Inc. for $6 billion, in November 2017. It is considered a move for consolidation in the semiconductor space. Marvel also acquired an Ethernet manufacturer, Aquantia Inc. for $452 million, earlier in May 2019. The Avera deal is subject to regulatory approvals & other customary closing conditions and is expected to close in Marvell's 2020 financial year. Source credits: https://siliconangle.com/2019/05/20/marvell-acquires-asic-chip-maker-avera-semiconductor-650m/